AI FOR PROPERTY & CASUALTY INSURANCE

Accelerate Claim Resolution Without Sacrificing Accuracy

Observe.AI helps insurers streamline claims handling by automating routine communications, improving adjuster accuracy, and increasing consistency across claims interactions—resulting in faster resolution and clearer experiences for policyholders.

Here’s how P&C insurers use Observe.AI

24/7 white-glove service

Fully automate your high-volume, routine policyholder interactions with empathetic, knowledgeable, and compliant AI agents that effectively address your policyholders’ needs with care in over 25+ languages and dialects.

- Policy coverage

- FNOL

- Billing and payments

- Renewals

Copilot for your team

Help your brokers, agents, underwriters, and representatives increase enrollments, reduce fraud, and drive retention by offloading compliance, validation, first-touch, and follow-up engagement steps to AI agents.

- Claims status and processing

- Payment follow-ups and confirmations

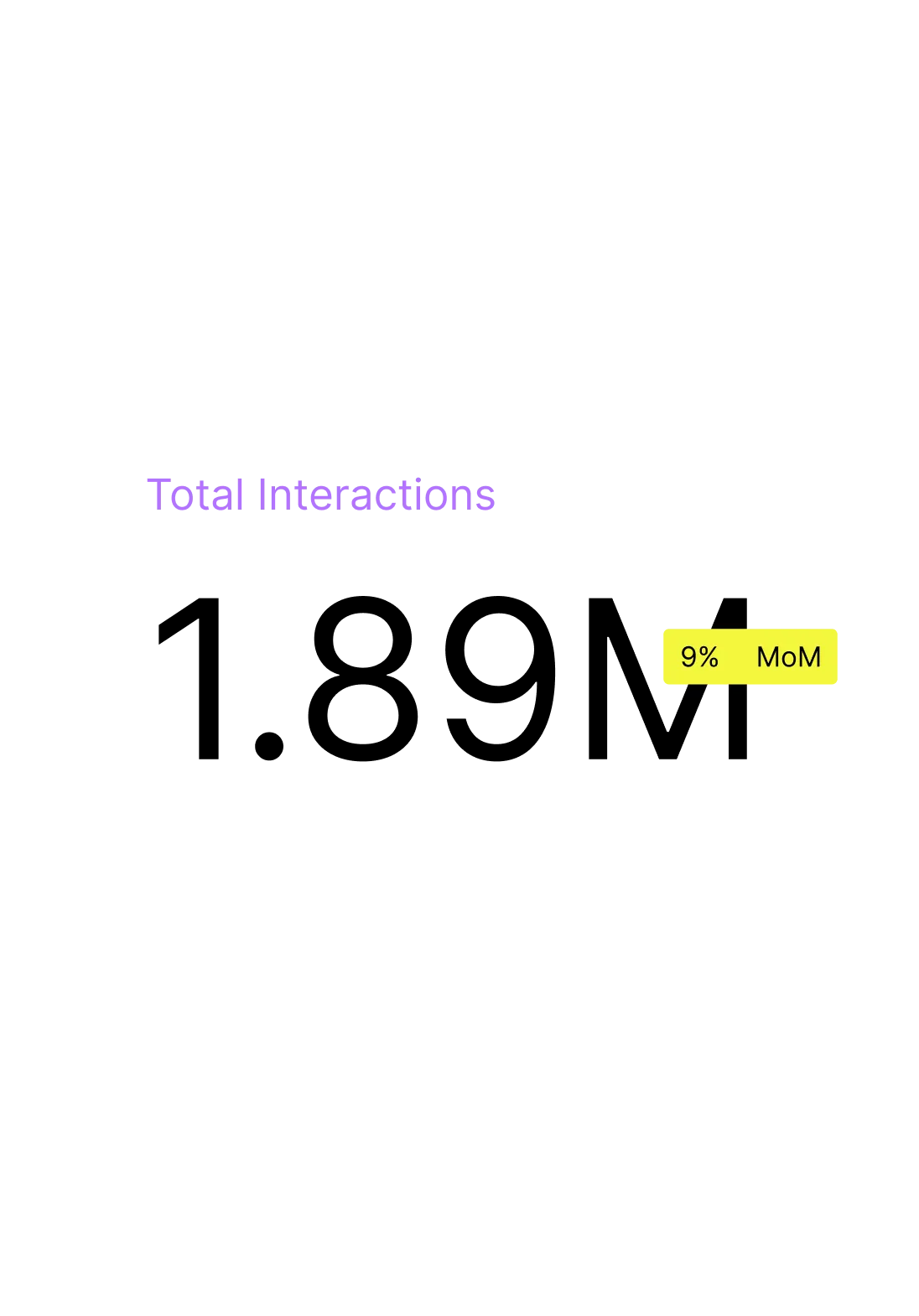

Improved insurance operations

Analyze 100% of all interactions to continuously improve and scale your AI agents and adopt data-driven optimization strategies that will enhance operations and bottom line.

- Policy cancellation drivers

- Agent training needs

- New product and service trends

- Potential compliance risks

Seamless integration with your insurance systems

Connect your AI Agents to the tools your teams already use

View all integrations

Why P&C enterprises prefer Observe.AI

01

01

Trusted Partner

As experts in customer experience with a deep understanding of human-to-human conversations, we work with you to identify more opportunities to seamlessly integrate AI Agents into your organization to address immediate needs with measurable results and drive long-term success.

02

02

Agentic Architecture

Easily create sophisticated AI agents that reflect your brand personality using natural language prompts. Your agents will accurately follow your processes and can take action by connecting with 250+ business systems.

03

03

AI Agent Trust

With a long history of successfully delivering conversation intelligence solutions for highly regulated industries, we have adopted rigorous quality assurance to effectively monitor and measure every AI Agent interaction for quality, compliance, and trust. Drill down reporting, alerting, simulations, and fallbacks give you the ability to deploy and scale with confidence.

04

04

Continuous Learning Loop

By continuously exposing AI Agents to real-world simulations and your actual call interactions, your agents will continue to learn and evolve with your business.

Real results from actual customers

Ready to invest in policyholder retention?

Let us show you how to optimize support delivery, operations, and compliance with AI Agents powered by leading contact experience AI.

FAQ

Observe.AI helps P&C insurers automate high-volume customer interactions such as policy coverage inquiries, billing questions, FNOL submissions, and renewals. AI Agents provide fast, accurate, and empathetic support 24/7, improving policyholder experience while reducing operational load.

Yes. AI Agents can collect and validate FNOL details, route cases appropriately, and communicate next steps to policyholders. By handling early-stage intake quickly and consistently, insurers can reduce wait times, speed up claims processing, and improve customer confidence during stressful moments.

Observe.AI offloads routine data validation, documentation, and follow-up steps, helping brokers, agents, and underwriters stay focused on higher-value tasks. Real-time guidance also improves accuracy and consistency, reducing the risk of incomplete or incorrect information that can increase fraud exposure.

Observe.AI analyzes 100% of customer interactions to uncover insights such as policy cancellation drivers, agent training needs, emerging product trends, and potential compliance risks. These insights help insurers improve operational efficiency, quality assurance, and policyholder retention.

Yes. By delivering faster resolutions, reducing friction during claims and support calls, and ensuring consistent communication, P&C insurers can improve policyholder satisfaction and loyalty. Customers have reported measurable gains such as increased retention, higher CSAT, and reduced handle times.